IRS 668-W(c)(DO) 2002-2026 free printable template

Show details

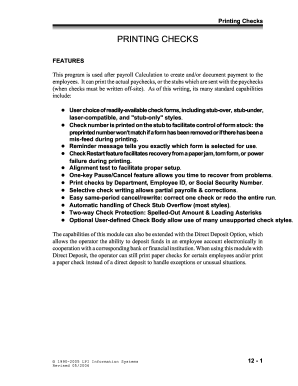

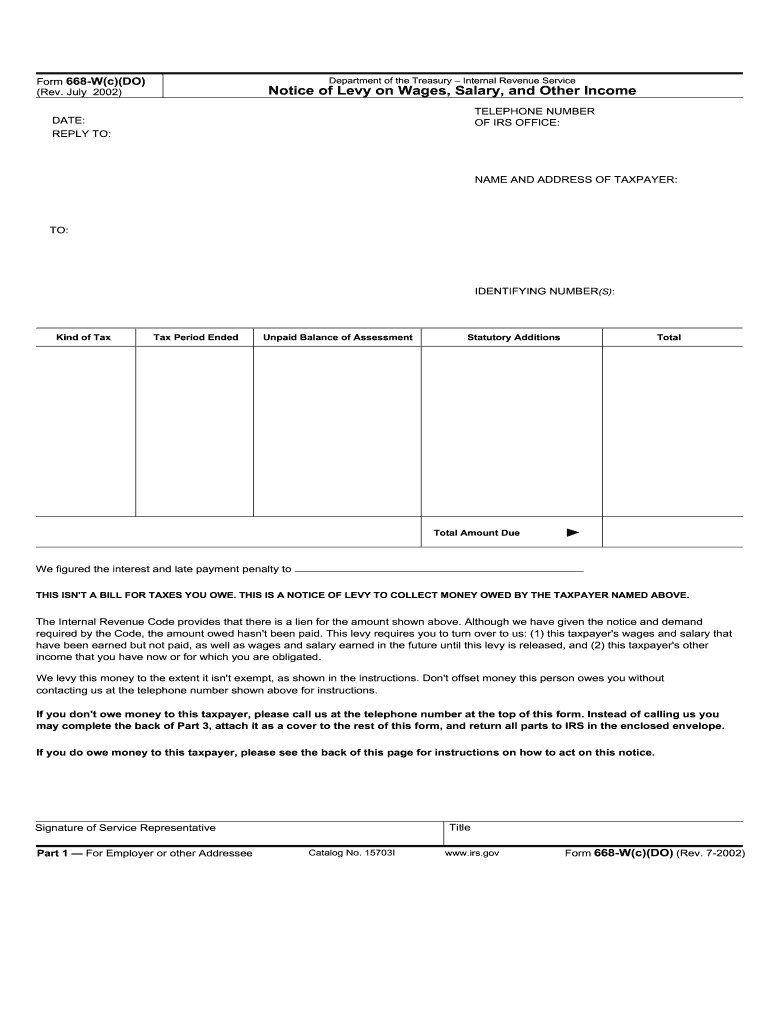

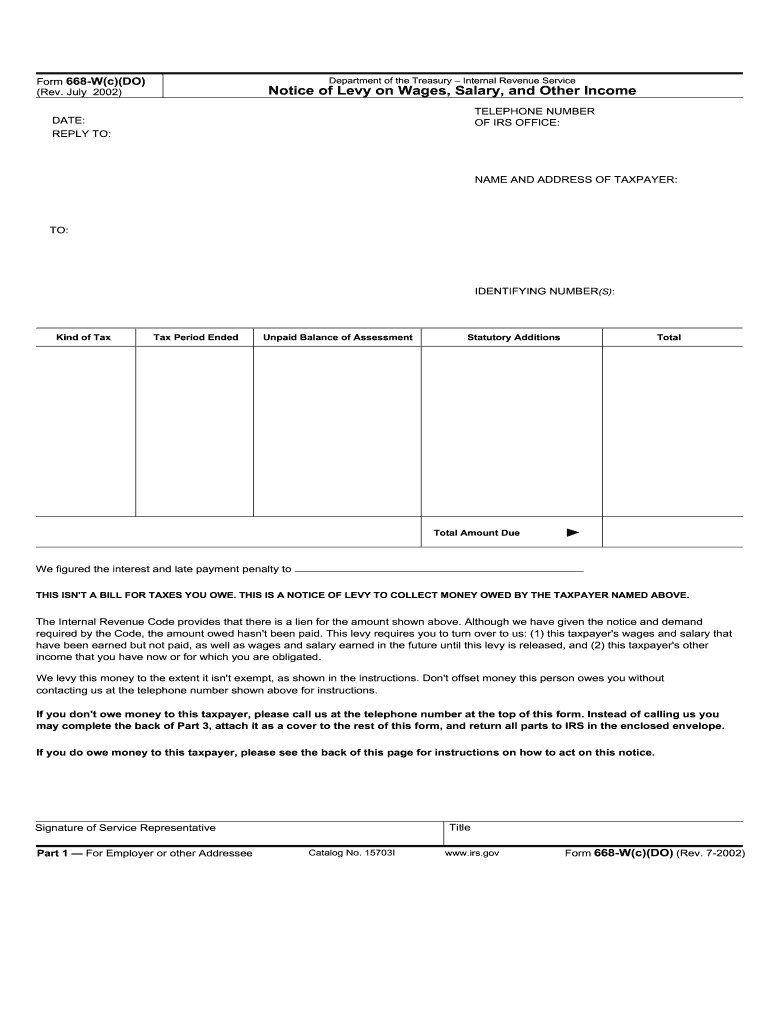

Form 668-W c DO Rev. July 2002 Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income TELEPHONE NUMBER OF IRS OFFICE DATE REPLY TO NAME AND ADDRESS OF TAXPAYER TO IDENTIFYING NUMBER S Kind of Tax Tax Period Ended Unpaid Balance of Assessment Statutory Additions Total Total Amount Due We figured the interest and late payment penalty to THIS ISN T A BILL FOR TAXES YOU OWE. THIS IS A NOTICE OF LEVY TO COLLECT MONEY OWED BY THE TAXPAYER NAMED ABOVE....

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign pdffiller form

Edit your form 668 w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 668 w pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form 668 w online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 668. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 668 w c

How to fill out IRS 668-W(c)(DO)

01

Obtain a copy of IRS Form 668-W(c)(DO) from the IRS website or your tax professional.

02

Fill in your personal details in the provided sections, including name, address, and Social Security number.

03

Enter the taxpayer information for whom the form is being submitted, if applicable.

04

Provide the details regarding the financial institution involved, including the name of the institution and account information.

05

Complete the section regarding income and expenses accurately, specifying amounts for wages, other income, and necessary expenses.

06

Sign and date the form at the bottom to confirm the information is true and correct to the best of your knowledge.

07

Submit the completed form to the IRS according to the instructions provided.

Who needs IRS 668-W(c)(DO)?

01

Individuals who have received a Notice of Levy for their wages from the IRS.

02

Taxpayers who are trying to resolve their tax liabilities and are negotiating a payment plan with the IRS.

03

Employers who need to communicate information about their employees' wages subject to levy.

04

Anyone undergoing a levy action and seeking to claim exemptions or negotiate their liabilities.

Fill

use the pdffiller mobile app w c do

: Try Risk Free

People Also Ask about 668w

How does IRS find bank accounts for levy?

In some cases, the IRS has your banking details from previous tax returns, and in other cases, it uses your social security number to find your bank account. Next, the IRS will send Notice of Levy on Wages, Salary, and Other Income, generally Form 668–A(C)DO to your bank.

Can the IRS put a levy on my bank account?

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

How long can the IRS keep a levy on your bank account?

If the IRS chooses a bank levy as the means of collection, they will contact your bank and require a hold on any funds in your account. That hold is in effect for 21 days—a period during which you can act to stop the levy.

How do I stop IRS bank levy?

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.

How do I remove IRS levy from my bank account?

You may appeal before or after the IRS places a levy on your wages, bank account, or other property. After the levy proceeds have been sent to the IRS, you may file a claim to have them returned to you. You may also appeal the denial by the IRS of your request to have levied property returned to you.

How do I contact the IRS about a bank levy?

Contact us toll-free at 800-829-7650 or 800-829-3903 to resolve the issue by paying the tax bill, entering into an installment agreement, or proposing an Offer in Compromise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 668 form directly from Gmail?

form 668 w part 3 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute 668 w form online?

pdfFiller makes it easy to finish and sign form 668a online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the irs form 668 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign irs form 668a on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS 668-W(c)(DO)?

IRS 668-W(c)(DO) is a form used by the Internal Revenue Service (IRS) to impose a levy on certain types of income, such as wages or other payments, to collect unpaid tax liabilities.

Who is required to file IRS 668-W(c)(DO)?

The IRS issues Form 668-W(c)(DO) to employers or financial institutions that are required to withhold payments from an individual's income to satisfy tax debts.

How to fill out IRS 668-W(c)(DO)?

To fill out IRS 668-W(c)(DO), the entity receiving the form must provide specified information regarding the taxpayer, such as their Social Security number (SSN), the amount of income to be withheld, and details of the levy as instructed by the IRS.

What is the purpose of IRS 668-W(c)(DO)?

The purpose of IRS 668-W(c)(DO) is to allow the IRS to collect outstanding tax debts by mandating third parties, such as employers, to withhold a portion of a taxpayer's income until the debt is resolved.

What information must be reported on IRS 668-W(c)(DO)?

Information required on IRS 668-W(c)(DO) includes the taxpayer's name, Social Security number, employer's information, the amount to be withheld, and details of any exemptions or supporting documentation.

Fill out your IRS 668-WcDO online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

668w Form is not the form you're looking for?Search for another form here.

Keywords relevant to irs 668 w

Related to form 668 w c do taxpayer named above

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.